Call Kurtis: Mortgage Modification Nightmare

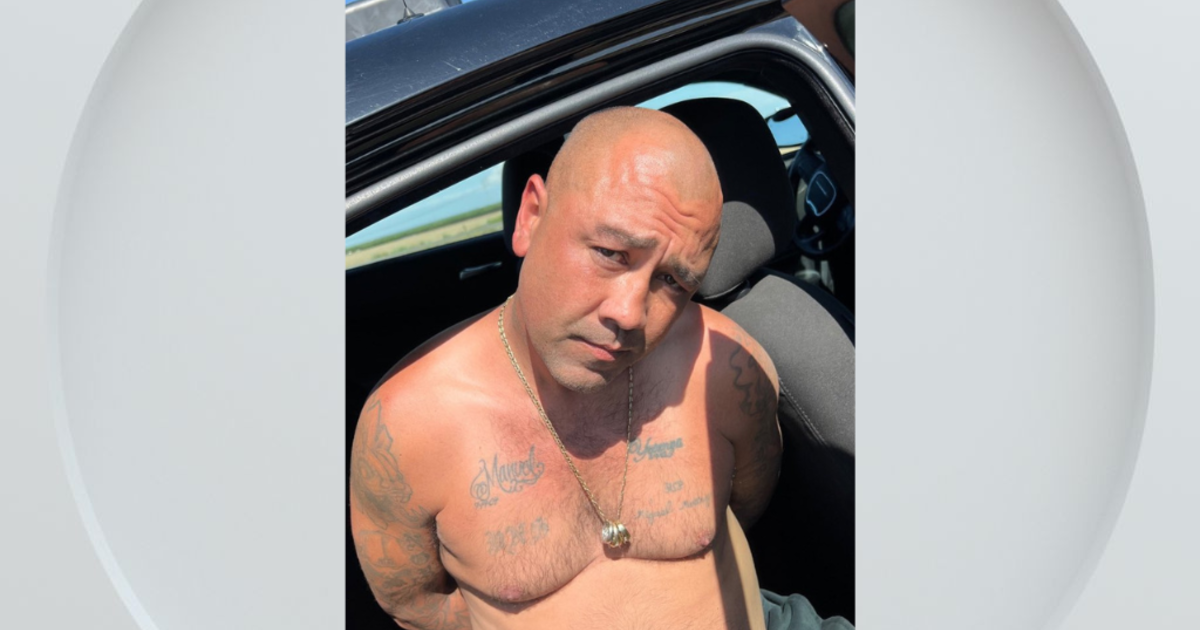

What appears to have been a series of unfortunate events has led to utter desperation for a viewer in Yuba County. Andy Schweitzer has been struggling to get his bank to right what he calls a serious wrong.

"I hold them directly responsible for wrecking my life," says Andy about Bank of America; he says they've turned his life upside down.

He says his Browns Valley house is on the brink of foreclosure.

"They're just trying to screw us Julie, that's all they're trying to do. It's horrible," Andy tells his wife as they trek across their back yard to his large work shed that contains what's left of his heavy equipment.

He and his wife started the process of a loan modification last year. Andy says he's hand-delivered his monthly mortgage payments on-time to his branch each month, but he says the bank didn't apply five of his payments toward his loan which caused his credit score to plummet.

"And this is the only thing I got left right now," he says referring to a Bobcat.

He runs his own concrete and landscape business, but his dropped-credit score forced his credit card company to reduce his line of credit. Without access to that credit line he's had to sell his equipment to cover his bills.

"I love it," he says, referring to his bright red and white dump truck. "It's like a piece of me and this is probably going to have to be the next piece of equipment to go."

And now he says Bank of America is telling him he doesn't qualify for a modification.

"And I go wait a minute, how can this be? I was qualified before this happened, you guys came into my life, stole my business from me and now you're telling me I don't qualify because I don't have income. It's catch 22."

After sending in his paperwork over and over again and having dozens of conversations he says the bank is even more confused when they call.

"Now you guys are going to short sale on me?" he asks the BofA rep on the other end of the phone.

"This is just never-ending! It's just the biggest joke in the world... The right hand's not knowing what the left hand's doing."

We contacted Bank of America.

According to them, when they consider someone for a loan modification they set up an escrow account. That's an account they force you to pay into each month to cover your homeowners insurance and property taxes.

Andy refused to pay into the account because he already paid his insurance and taxes on his own. So the bank considered his monthly mortgage payment short: "…those partial payments were held until the full payment amount was available."

That most likely hurt his credit score, but the bank did agree to remove the late charges from his credit report, saying "...the corrected information was submitted... to the credit reporting agencies."

Bank of America says they are not foreclosing on Andy, and it's still reviewing him for a modification. After what Andy's been through, he doesn't believe them.

The calls keep coming: "I don't want to be transferred."

Andy's fight to stay in his home is far from over.

"I'm not going to stop fighting this; I don't have anything else to lose. I've lost my business, I'm losing my home, I lost my financial future, I lost everything. The only thing I can do is fight right now."

When you go into a loan modification program it's standard for banks to require those escrow accounts. And you should also know that even if a bank agrees to lower your payments during the modification process, those partial payments will cause your credit score to drop.