CBS News Live

CBS News Sacramento: Local News, Weather & More

Watch CBS News

Hundreds gathered in Grass Valley on Tuesday to honor the life and legacy of Lieutenant Commander Lou Conter, who was the last living survivor of the USS Arizona.

There were 335 Arizona crew members who escaped the flames and ocean water with their lives on the fateful day that would forever change world history

The Grass Valley resident passed peacefully in his sleep on April 1, 2024, at the age of 102.

Students protesting the violence in Gaza have brought the Mideast conflict home with an encampment occupying the steps of Sproul Plaza on the Cal campus in Berkeley, and they say they're not leaving until their demands are met.

A new CDC study found that not enough women are up to date with their mammograms.

A new report shows homebuyers in Modesto, are paying 30% more for their new homes than what they're worth.

Cal Poly Humboldt will be closed through at least Wednesday, officials say, after pro-Palestinian protests clashed with police on Monday.

California lawmakers are considering a law to stop a line-skipping service at airport screenings.

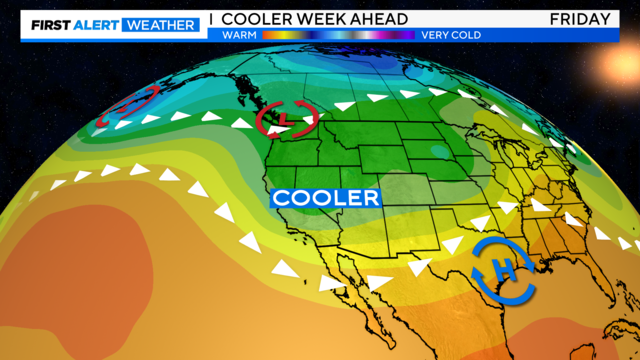

Temperatures have cooled off Tuesday as our weather pattern changes heading into the end of the week. Will there be any showers along with our pattern change?

An El Dorado County man is bringing his need for speed to life after building his own RC race track on his property.

Hundreds gathered in Grass Valley on Tuesday to honor the life and legacy of Lieutenant Commander Lou Conter, who was the last living survivor of the USS Arizona.

The Supreme Court is now weighing a ban on sleeping outdoors, which could be a game changer for how Sacramento handles homeless encampment enforcement.

Watts will raise awareness of serious issues impacting Californians, hold local officials accountable, obtain answers for viewers and provide solutions.

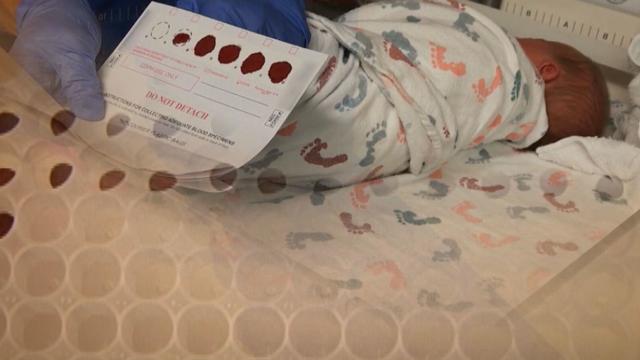

California law says genetic testing companies have to get your permission before they store, use or sell your DNA, but the state itself doesn't have to get your permission and has been storing DNA samples from every baby born there since the '80s. Lawmakers want to change that, but face an uphill battle.

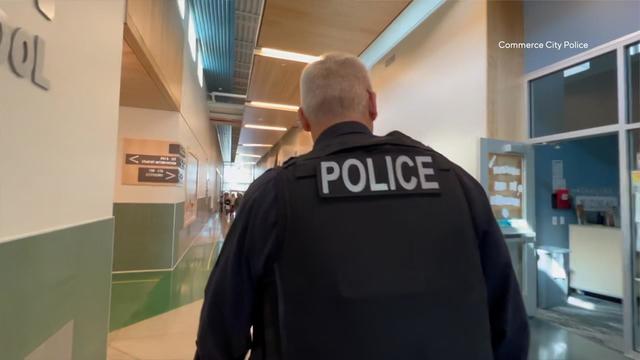

A bill introduced in the wake of our "Handcuffs in Hallways" investigation aims to reduce "unnecessary" calls for police at schools. But one California lawmaker could kill it without a vote.

California lawmakers are considering a law to stop a line-skipping service at airport screenings.

From the Sacramento River to the coast, salmon populations have struggled to survive and California has put another ban on fishing for them for another year. Here are the problems the fish are facing and what's being done to save them.

Google confirmed it has fired additional employees for being involved in protests at the tech company's Sunnyvale and New York City offices to oppose a $1.2 billion contract with Israel.

California lawmakers on Monday rejected a proposal aimed at cracking down on how some of the nation's largest utilities spend customers' money.

On Earth Day, California Governor Gavin Newsom was joined by other state officials and activists to announce the newest state park – and the first since 2014 – in Stanislaus County.

Mayors from some of California's biggest cities gathered in Sacramento on Tuesday asking the governor and legislature for some serious cash to address the state's homeless crisis.

A new CDC study found that not enough women are up to date with their mammograms.

California lawmakers are considering a law to stop a line-skipping service at airport screenings.

A report shows those looking to buy homes in Modesto and Stockton are paying around 30% more for their new homes than their expected value.

An El Dorado County man is bringing his need for speed to life after building his own RC race track on his property.

A controversial figure from the Oakland Athletics' recent history says he wants to be appointed the team's manager when they move to Sacramento.

Zack Gelof hit a two-run homer off Victor González in the ninth, and the Oakland Athletics stopped an eight-game losing streak in the Bronx by beating the Yankees 2-0 following the first-inning ejection of New York manager Aaron Boone over what appeared to be a fan remark aimed at the plate umpire.

Brandon Aiyuk is staying away from the San Francisco 49ers facility at the start of the offseason program as he seeks a lucrative long-term contract.

The Lyrid meteor show is set to peak as the week begins.

NASA confirmed Monday that a mystery object that crashed through the roof of a Naples, Florida home last month was space junk from equipment discarded by the space station.

NASA flight engineers managed to photograph and videotape the moon's shadow on Earth about 260 miles below them.

Students protesting the violence in Gaza have brought the Mideast conflict home with an encampment occupying the steps of Sproul Plaza on the Cal campus in Berkeley, and they say they're not leaving until their demands are met.

California lawmakers are considering a law to stop a line-skipping service at airport screenings.

Google confirmed it has fired additional employees for being involved in protests at the tech company's Sunnyvale and New York City offices to oppose a $1.2 billion contract with Israel.

The Senate passed the foreign aid package, which includes a provision that could lead to a ban on TikTok, after months of disagreement in Congress.

California lawmakers on Monday rejected a proposal aimed at cracking down on how some of the nation's largest utilities spend customers' money.

The victims are smart, they're savvy, and they're still getting tricked.

The state regulates crematoriums for people, but we've learned there is zero oversight for pet crematoriums.

Kurtis Ming has had conversations with people in our community about the impact of inflation on their personal finances. It's forcing some to make some tough choices.

Customers who rely on government assistance programs can get same perks as Prime members, for less.

UnitedHealth said it paid the criminals behind attack that crippled hospitals and pharmacies to protect sensitive patient data.

Warmer weather is prime time for ticks that can carry Lyme disease and other illnesses. Here's how to spot them and get rid of them.

The Senate passed the foreign aid package, which includes a provision that could lead to a ban on TikTok, after months of disagreement in Congress.

Antisemitic chants and even threats against Jewish students have brought the tension of the Middle East onto U.S. college campuses.

Organizers of the annual Outside Lands Music Festival at San Francisco's Golden Gate Park revealed the lineup for the 2024 event.

Mary J. Blige, Cher, Foreigner, A Tribe Called Quest, Kool & The Gang, Ozzy Osbourne, Dave Matthews Band and Peter Frampton have been named to the Rock & Roll Hall of Fame.

Taylor Swift broke her own records, Spotify said, and now owns the record for the top three most-streamed albums in a single day.

The singer was found deceased at her home, a representative said.

Anticipation was growing at a fever pitch before Taylor Swift's latest album, "The Tortured Poets Department," dropped at midnight EDT. But it turned out it's actually a double album.

A new CDC study found that not enough women are up to date with their mammograms.

UnitedHealth said it paid the criminals behind attack that crippled hospitals and pharmacies to protect sensitive patient data.

Anti-abortion advocates rallied in Sacramento today for the fourth annual March for Life. Some said Californians should know there are more resources out there than getting abortions.

The CDC estimates the U.S. could reach 300 measles cases in 2024 — more than the recent peak two years ago.

Every year, hundreds of thousands of people are diagnosed with breast cancer. Research shows the number of cases in younger women under the age of 40 is on the rise.

Amazon announced Monday that it suspended its drone delivery operations in the California Central Valley community of Lockeford.

The victims are smart, they're savvy, and they're still getting tricked.

Google began removing California news sites from some user's search results, a test that acted as a threat should the state pass a law requiring the search giant to pay media companies for linking to their content.

Long lunch lines, friendly hellos, and a greater social atmosphere – could all of that return to downtown Sacramento with the return of state workers? Some businesses seem to think so.

A California lawmaker introduced a bill that would end exclusive control of ticket sales by companies like Ticketmaster.

Amazon announced Monday that it suspended its drone delivery operations in the California Central Valley community of Lockeford.

Google confirmed it has fired additional employees for being involved in protests at the tech company's Sunnyvale and New York City offices to oppose a $1.2 billion contract with Israel.

The victims are smart, they're savvy, and they're still getting tricked.

California lawmakers on Monday rejected a proposal aimed at cracking down on how some of the nation's largest utilities spend customers' money.

A bill in California wants to make more rental housing available to tenants with pets.

Two animal welfare measures are moving forward at the California State Capitol with the goal of humanely controlling evergrowing pet populations.

A mountain lion snatched and killed a cat overnight in Calaveras County, the pet's owner told CBS Sacramento on Thursday.

A Natomas woman said the typical trip to the dog park ended in tragedy, with her pet being attacked and killed.

A suspect is sought after 73 dogs were seized across three properties in the city of Turlock last week, authorities said Tuesday.

A Sacramento family is sharing their story after an unexpected delivery in the middle of the night. Someone left a malnourished puppy at their front door and ran off.

The conversation surrounding California's water continues. The Sites Reservoir project northwest of Sacramento has a price tag of $4 billion and is funded by local, state and federal dollars.

The Regional Water Authority is working on creating a "bank" to store water underground doubling the capacity of groundwater stored.

There's one Northern California reservoir that hasn't rebounded despite this winter's rain and snow.

If you want to measure the success of this winter, California's largest reservoir is a good way to do it. As of Friday, Shasta is about three feet away from full, and that's a foot higher than where it was on Monday.

The DWR upped its water release amount this week. On Wednesday 18,000 cfs were released and 20,000 cfs on Thursday.

A Yuba City mom started a baseball team for kids with physical and intellectual disabilities after finding her 11-year-old son with Down Syndrome didn't have anywhere to play.

A Sacramento nonprofit is teaming up with a local credit union to give back so seniors can safely do basic tasks like bathing or exercising. Those lending a helping hand are also a group of seniors.

The high school players have trained hard all season to make Friday night's finals, and they didn't let their physical and mental challenges get in the way of playing a good game.

NFL Hall of Famer Tim Brown is hosting his 23rd youth football camp at Sacramento State, an annual event that is part of a mentorship program for underserved young people.

An inspiring love story is still being written chapter by chapter at the Brookdale Folsom home for seniors. That's where Faye Guerrero and Rob Trueax found love again after loss.