CBS News Live

CBS News Sacramento: Local News, Weather & More

Watch CBS News

Multiple sources have confirmed with CBS 13 that the victim who was stabbed to death near tower bridge over the weekend was a sophomore at Center High School in Antelope.

Stockton Taking Action Against Retail Theft (STAART) aims to put the power to stop retail theft into a business owner's hands and it could help the San Joaquin District Attorney put more cuffs on more suspects.

Governor Gavin Newsom is seeking a bold new step to open California medical facilities to Arizona doctors for abortions on their patients after the state's Supreme Court upheld an 1864 abortion ban.

Sacramento, and much of California, received unfavorable grades in this year's State of the Air report from the American Lung Association.

A new rule in California aims to limit health care price increases to just 3% each year.

Cal Poly Humboldt will remain closed through at least the weekend after pro-Palestinian protests clashed with police and demonstrators occupied buildings and refused to leave.

A suspect in a deadly Stockton shooting last summer was arrested during a traffic stop in Alameda County on Tuesday, police said.

A former Gridley teacher pled no contest to having sex with an 8th-grade student on the day of his graduation in 2021, according to the Butte County District Attorney's Office.

The Senate Committee on Insurance passed a bill Wednesday that lawmakers said will address the cost and availability of fire insurance in California.

A new report shows homebuyers in Modesto, are paying 30% more for their new homes than what they're worth.

An El Dorado County man is bringing his need for speed to life after building his own RC race track on his property.

Hundreds gathered in Grass Valley on Tuesday to honor the life and legacy of Lieutenant Commander Lou Conter, who was the last living survivor of the USS Arizona.

Watts will raise awareness of serious issues impacting Californians, hold local officials accountable, obtain answers for viewers and provide solutions.

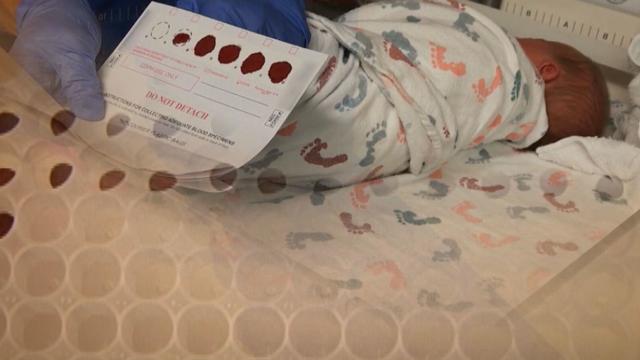

California law says genetic testing companies have to get your permission before they store, use or sell your DNA, but the state itself doesn't have to get your permission and has been storing DNA samples from every baby born there since the '80s. Lawmakers want to change that, but face an uphill battle.

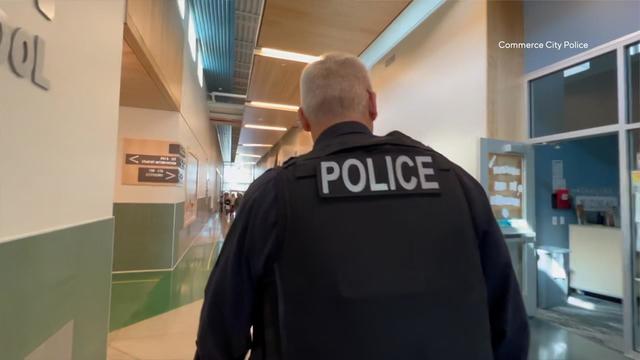

A bill introduced in the wake of our "Handcuffs in Hallways" investigation aims to reduce "unnecessary" calls for police at schools. But one California lawmaker could kill it without a vote.

Sacramento, and much of California, received unfavorable grades in this year's State of the Air report from the American Lung Association.

A new rule in California aims to limit health care price increases to just 3% each year.

A former Gridley teacher pled no contest to having sex with an 8th-grade student on the day of his graduation in 2021, according to the Butte County District Attorney's Office.

The Senate Committee on Insurance passed a bill Wednesday that lawmakers said will address the cost and availability of fire insurance in California.

Arizona doctors could give their patients abortions in California under a proposal announced Wednesday by Gov. Gavin Newsom to circumvent a ban on nearly all abortions in that state.

There's a new effort to make school meals healthier. So what are the changes announced by the U.S. Department of Agriculture, and when will your student start to see them? Here's The Answer.

It's a mission to put handcuffs on more suspects.

Governor Gavin Newsom is seeking a bold new step to open California medical facilities to Arizona doctors for abortions on their patients after the state's Supreme Court upheld an 1864 abortion ban.

Here's a look at the weather forecast Wednesday evening.

The Senate Committee on Insurance passed a bill Wednesday that lawmakers said will address the cost and availability of fire insurance in California.

The Minnesota Timberwolves' Naz Reid narrowly beat out the Sacramento Kings' Malik Monk for the NBA's Sixth Man of the Year award on Wednesday.

The San Jose Sharks announced Wednesday that head coach David Quinn has been relieved of his duties, following one of the worst seasons in team history.

San Francisco Giants left-hander Blake Snell was scratched from Wednesday's scheduled start against the New York Mets and placed on the 15-day injured list with a left adductor strain.

In November 2023, NASA's Voyager 1 spacecraft stopped sending "readable science and engineering data."

The Lyrid meteor show is set to peak as the week begins.

NASA confirmed Monday that a mystery object that crashed through the roof of a Naples, Florida home last month was space junk from equipment discarded by the space station.

A new rule in California aims to limit health care price increases to just 3% each year.

Governor Gavin Newsom is seeking a bold new step to open California medical facilities to Arizona doctors for abortions on their patients after the state's Supreme Court upheld an 1864 abortion ban.

Arizona doctors could give their patients abortions in California under a proposal announced Wednesday by Gov. Gavin Newsom to circumvent a ban on nearly all abortions in that state.

"America is a nation founded on the promise of second chances," President Biden said in a statement.

The USDA had floated banning flavored milk options from some school lunches.

The victims are smart, they're savvy, and they're still getting tricked.

The state regulates crematoriums for people, but we've learned there is zero oversight for pet crematoriums.

Kurtis Ming has had conversations with people in our community about the impact of inflation on their personal finances. It's forcing some to make some tough choices.

Arizona doctors could give their patients abortions in California under a proposal announced Wednesday by Gov. Gavin Newsom to circumvent a ban on nearly all abortions in that state.

"America is a nation founded on the promise of second chances," President Biden said in a statement.

Lawmakers argue the Chinese government can use the widely popular video-sharing app as a spy tool and to covertly influence the U.S. public.

Expanded federal overtime rule could result in employers paying workers an additional $1.5 billion, according to one estimate.

Logan Webb pitched eight strong innings and extended his scoreless streak to a career-high 19 as the San Francisco Giants beat the New York Mets 5-1 on Tuesday night.

Organizers of the annual Outside Lands Music Festival at San Francisco's Golden Gate Park revealed the lineup for the 2024 event.

Mary J. Blige, Cher, Foreigner, A Tribe Called Quest, Kool & The Gang, Ozzy Osbourne, Dave Matthews Band and Peter Frampton have been named to the Rock & Roll Hall of Fame.

Taylor Swift broke her own records, Spotify said, and now owns the record for the top three most-streamed albums in a single day.

The singer was found deceased at her home, a representative said.

Anticipation was growing at a fever pitch before Taylor Swift's latest album, "The Tortured Poets Department," dropped at midnight EDT. But it turned out it's actually a double album.

A new rule in California aims to limit health care price increases to just 3% each year.

Governor Gavin Newsom is seeking a bold new step to open California medical facilities to Arizona doctors for abortions on their patients after the state's Supreme Court upheld an 1864 abortion ban.

A new CDC study found that not enough women are up to date with their mammograms.

UnitedHealth said it paid the criminals behind attack that crippled hospitals and pharmacies to protect sensitive patient data.

Anti-abortion advocates rallied in Sacramento today for the fourth annual March for Life. Some said Californians should know there are more resources out there than getting abortions.

Amazon announced Monday that it suspended its drone delivery operations in the California Central Valley community of Lockeford.

The victims are smart, they're savvy, and they're still getting tricked.

Google began removing California news sites from some user's search results, a test that acted as a threat should the state pass a law requiring the search giant to pay media companies for linking to their content.

Long lunch lines, friendly hellos, and a greater social atmosphere – could all of that return to downtown Sacramento with the return of state workers? Some businesses seem to think so.

A California lawmaker introduced a bill that would end exclusive control of ticket sales by companies like Ticketmaster.

Amazon announced Monday that it suspended its drone delivery operations in the California Central Valley community of Lockeford.

Google confirmed it has fired additional employees for being involved in protests at the tech company's Sunnyvale and New York City offices to oppose a $1.2 billion contract with Israel.

The victims are smart, they're savvy, and they're still getting tricked.

California lawmakers on Monday rejected a proposal aimed at cracking down on how some of the nation's largest utilities spend customers' money.

A bill in California wants to make more rental housing available to tenants with pets.

Two animal welfare measures are moving forward at the California State Capitol with the goal of humanely controlling evergrowing pet populations.

A mountain lion snatched and killed a cat overnight in Calaveras County, the pet's owner told CBS Sacramento on Thursday.

A Natomas woman said the typical trip to the dog park ended in tragedy, with her pet being attacked and killed.

A suspect is sought after 73 dogs were seized across three properties in the city of Turlock last week, authorities said Tuesday.

A Sacramento family is sharing their story after an unexpected delivery in the middle of the night. Someone left a malnourished puppy at their front door and ran off.

The conversation surrounding California's water continues. The Sites Reservoir project northwest of Sacramento has a price tag of $4 billion and is funded by local, state and federal dollars.

The Regional Water Authority is working on creating a "bank" to store water underground doubling the capacity of groundwater stored.

There's one Northern California reservoir that hasn't rebounded despite this winter's rain and snow.

If you want to measure the success of this winter, California's largest reservoir is a good way to do it. As of Friday, Shasta is about three feet away from full, and that's a foot higher than where it was on Monday.

The DWR upped its water release amount this week. On Wednesday 18,000 cfs were released and 20,000 cfs on Thursday.

A Yuba City mom started a baseball team for kids with physical and intellectual disabilities after finding her 11-year-old son with Down Syndrome didn't have anywhere to play.

A Sacramento nonprofit is teaming up with a local credit union to give back so seniors can safely do basic tasks like bathing or exercising. Those lending a helping hand are also a group of seniors.

The high school players have trained hard all season to make Friday night's finals, and they didn't let their physical and mental challenges get in the way of playing a good game.

NFL Hall of Famer Tim Brown is hosting his 23rd youth football camp at Sacramento State, an annual event that is part of a mentorship program for underserved young people.

An inspiring love story is still being written chapter by chapter at the Brookdale Folsom home for seniors. That's where Faye Guerrero and Rob Trueax found love again after loss.