Call Kurtis Investigates: Metro Fire Won't Refund $1.3M In Taxes It Shouldn't Have Collected

Connect with this story on Twitter with hashtag #MetroFireTax. There is an update to this story.

RANCHO CORDOVA (CBS13) -- A Sacramento fire district that wrongly taxed homeowners more than $3 million due to a clerical error will not be issuing a full refund of that money, a Call Kurtis investigation has learned.

Sacramento Metropolitan Fire District said it will only return about half of that money, angering some homeowners who were charged as much as $800 since 2005.

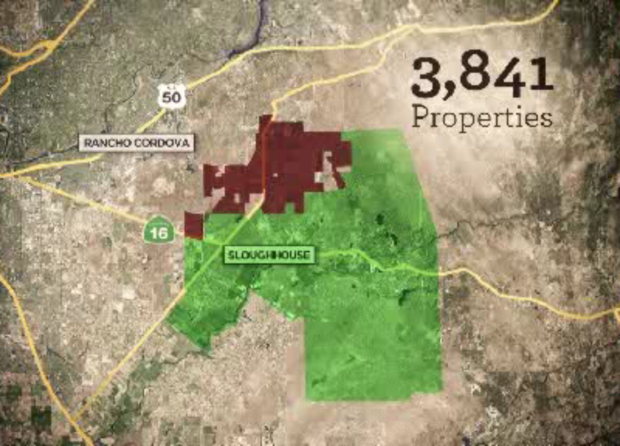

The agency told CBS Sacramento Jan. 10 it would offer tax refunds, after an audit discovered 3,841 Rancho Cordova properties had been wrongly charged an annual $100 fire tax.

An agency letter sent to property owners explained it had collected a "Special Fire Tax" by mistake for tax years 2009-13. Owners were also sent a refund application for those four years.

But Metro Fire's letter didn't mention the agency's erroneous tax actually began in 2005. The agency said it will not return the $1.3 million it wrongly collected during those earlier years.

In total, the agency collected a total of $3.01 million from taxpayers it never should have taxed, a Call Kurtis investigation learned.

"A $400 check in your mailbox is awesome," said homeowner Andy Payne of Rancho Cordova, who received her refund check in mid-February for tax years 2009-13. But she found her tax records prove she paid the fire tax since she moved in to the Anatolia neighborhood in 2005.

She thinks she's owed the rest of her money back -- which is at least $300.

Michael Darrett, who moved into the Kavala Ranch neighborhood in 2008, said he paid the $100 "Sloughhouse Fire Protection" tax for five years, costing him $500.

He said he'll only get back $400.

"They told me that legally they only have to pay me for four years," he said.

"[Metro Fire is] ignoring the fact that there's four years that [it] still took money from us," Payne said.

Metro Fire spokesman Deputy Chief Chris Holbrook told consumer investigator Kurtis Ming the agency would like to return the full $3.0 million it wrongly collected, but claims its hands are tied.

"Why are you only going back four years?" Ming said.

"Per legal counsel, the limitations on that was four years that we could refund," Holbook said.

The agency cited its legal counsel's interpretation of CA Revenue and Taxation Code 5097(a).

Ming asked for further clarification.

"You're telling me you can't legally return money that you never should have taken in the first place?" he said.

"Yes," Holbrook said, "according to legal counsel, the statute of limitation is four years."

"I don't think that's quite true," said professor John Sims of Pacific McGeorge School of Law.

Sims said that specific code section actually means courts cannot force a public agency to pay back taxes collected beyond four years.

"That's not the same thing as saying they're not allowed to pay," Sims said.

"So, legally they can hide behind this statute, but morally they have every opportunity to pay this back?" Ming asked.

"I believe so," said Sims. "They just apparently don't want to."

Taxpayer advocate Jon Coupal doesn't think that's right.

"In any situation where a tax has been collected illegally, that money should go back to the taxpayers," he said.

But Metro Fire stood by the amount its refunding -- about 56 percent of what the agency wrongly collected.

"We absolutely feel we did that within the confines of the California tax code," Holbrook said.

"Conveniently, that means some money is going to be kept that never should have been collected to begin with?" Ming asked.

"I don't necessarily buy into 'conveniently,'" Holbrook said. "I think it's unfortunate."

Sims again disagreed.

"It's not really 'unfortunate' for them if it's their choice not to make the payments back," he said.

"It's disheartening," Darrett told Call Kurtis.

Payne realized she may not win in court under the statute, but said she thinks Metro Fire is cheating homeowners by hiding behind the law.

"We're the little man," she said. "We don't want to be taken advantage of, especially by the fire district."

Homeowners owed money must apply with Metro Fire to receive a refund. We've posted the refund form (PDF) as well as the letter sent to homeowners (PDF). The agency said it has received about 1,400 claims as of Feb. 19. Property owners are urged to contact Metro Fire at 800-676-7516 with any questions they may have.

Taxpayer advocate Jon Coupal thinks Metro Fire should at least provide some sort of tax credits to anyone who won't get their full refund.

The original audit that discovered the mistake is available here (PDF).

The agency said the person who made the original clerical error has since retired.

What do you think of the tax? Tweet @cbs13callkurtis using the hashtag #MetroFireTax.